Applying for a residential mortgage can be an exciting but daunting process, especially if you’re a first-time homebuyer. Before you start the application process, there are several important factors to consider to ensure you make an informed decision.

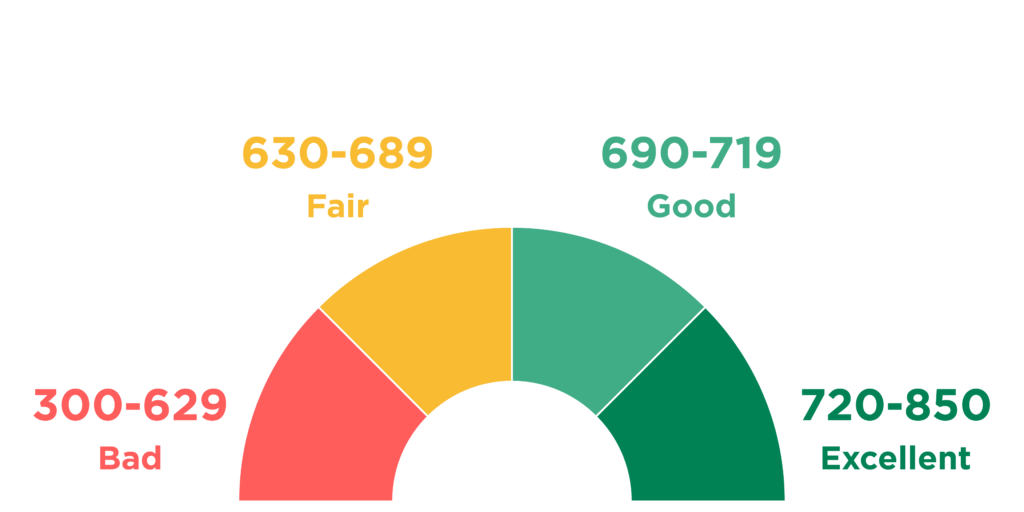

- Your credit score: Your credit score is a crucial factor in determining whether you qualify for a mortgage and the interest rate you’ll receive. A higher credit score typically results in a lower interest rate, which can save you thousands of dollars over the life of your mortgage. Check your credit score before you apply and take steps to improve it if necessary.

- Your debt-to-income ratio: Lenders will also consider your debt-to-income ratio, which is the percentage of your income that goes towards debt payments. A lower ratio is generally more favorable and can increase your chances of being approved for a mortgage.

- Down payment: You’ll need to have a down payment ready to purchase a home. In Canada, a down payment of at least 5% is required for homes up to $500,000, and a higher down payment is required for more expensive homes. The larger your down payment, the lower your mortgage payments will be.

- Type of mortgage: There are several types of mortgages available in Canada, including fixed-rate and adjustable-rate mortgages. Each type of mortgage has its own benefits and drawbacks, so it’s important to understand the differences and choose the right one for your needs.

- Closing costs: When you purchase a home, you’ll also need to pay closing costs, which can include legal fees, title insurance, and land transfer taxes. These costs can add up quickly, so it’s important to budget for them ahead of time.

At our mortgage company, we understand the importance of making an informed decision when applying for a residential mortgage. Our team of mortgage professionals can help guide you through the process and offer professional mortgage services to meet your needs. Contact us today to learn more.

Sources:

- “Mortgage Basics” from the Financial Consumer Agency of Canada: https://www.canada.ca/en/financial-consumer-agency/services/mortgages.html

- “Types of Mortgages” from the Government of Canada: https://www.canada.ca/en/financial-consumer-agency/services/mortgages/types-mortgages.html

- “Calculating Debt Service Ratios” from the Canada Mortgage and Housing Corporation: https://www.cmhc-schl.gc.ca/en/finance-and-investing/mortgage-loan-insurance/mortgage-default-insurance/calculating-debt-service-ratios

“Closing Costs and Additional Expenses When Buying a Home” from the Government of Canada: https://www.canada.ca/en/financial-consumer-agency/services/mortgages/buying-home/closing-costs.html